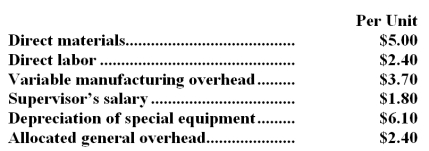

Outram Corporation is presently making part I14 that is used in one of its products.A total of 8,000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $14.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company,none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part I14 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

An outside supplier has offered to make and sell the part to the company for $14.80 each.If this offer is accepted,the supervisor's salary and all of the variable costs can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company,none of which would be avoided if the part were purchased instead of produced internally.If management decides to buy part I14 from the outside supplier rather than to continue making the part,what would be the annual impact on the company's overall net operating income?

Definitions:

Environmentally Induced

Conditions or changes in an organism that are caused by external environmental factors rather than genetic influences.

Failure To Thrive Syndrome

A medical condition, often seen in infants, characterized by a failure to gain weight and grow as expected for age and sex.

Nutrition

The process by which organisms take in and utilize food materials, essential for growth, repair, and maintenance of health.

Canalization

A genetic concept explaining how genotype restrictions lead to predetermined phenotypic outcomes despite environmental variations.

Q2: Part WY4 costs the Eastern Division of

Q5: According to the formula in the text,what

Q7: Auchmoody Corporation has two operating divisions-a Consumer

Q10: A customer has requested that Daleske Corporation

Q17: Suppose that Division A is operating at

Q28: During the most recent month at Hybarger

Q29: The nurse is attempting to assess a

Q52: (Ignore income taxes in this problem. )

Q58: What was Mzimba's variable overhead rate variance?<br>A)$8,514

Q125: What is the variable overhead rate variance