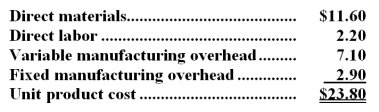

Ries Corporation has received a request for a special order of 8,000 units of product R34 for $34.20 each.The normal selling price of this product is $35.70 each,but the units would need to be modified slightly for the customer.The normal unit product cost of product R34 is computed as follows:  Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product R34 that would increase the variable costs by $6.30 per unit and that would require a one-time investment of $40,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Direct labor is a variable cost.The special order would have no effect on the company's total fixed manufacturing overhead costs.The customer would like some modifications made to product R34 that would increase the variable costs by $6.30 per unit and that would require a one-time investment of $40,000 in special molds that would have no salvage value.This special order would have no effect on the company's other sales.The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order.Show your work!

Definitions:

Financial Performance

An assessment of how well an organization manages its resources and commitments to generate income and ensure sustainability.

Inventory Turnover

A ratio showing how many times a company's inventory is sold and replaced over a specific period, indicating the efficiency of inventory management.

Cost-Benefit Ratio

A financial assessment tool that compares the costs of an action or project to its benefits, to determine its feasibility or value.

Leverage Ratio

A financial metric indicating the level of a company's debt in relation to its equity or assets.

Q11: How much of the $130,000 actual Food

Q16: The following data for January have been

Q20: Zaccagnino Corporation makes a range of products.The

Q21: What was Mzimba's fixed manufacturing overhead volume

Q27: The nurse is admitting a client of

Q39: The constrained resource at Schiller Corporation is

Q41: The contribution margin of the South business

Q58: The variable overhead rate variance is:<br>A)$345 F<br>B)$95

Q121: Dennehy Corporation,which makes sophisticated industrial valves,has provided

Q128: The net present value method assumes that