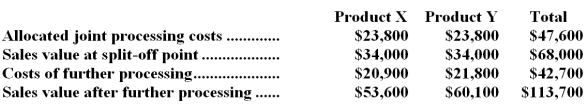

Iacollia Company makes two products from a common input.Joint processing costs up to the split-off point total $47,600 a year.The company allocates these costs to the joint products on the basis of their total sales values at the split-off point.Each product may be sold at the split-off point or processed further.Data concerning these products appear below:  Required:

Required:

a.What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point?

b.What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point?

c.What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?

d.What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Definitions:

PLC Programming Language

A specialized language designed for programming logic controllers, used to control industrial processes and machinery.

Status Bit

A binary indicator used within computing and digital electronics to represent the current state or condition of a system or component.

Switches

Devices used to connect or disconnect electrical circuits, allowing for the control of power flow or signal paths in a system.

Pushbuttons

Manual switches that, when pressed, complete an electrical circuit to initiate a function or process.

Q1: Suppose that the Albany Division buys the

Q5: All other things the same,if a division's

Q14: Which of the following would be the

Q27: If the Carrot product line would have

Q53: From the standpoint of the entire company,if

Q69: Assume that Cranberry was being evaluated solely

Q81: Information on four investment proposals is given

Q85: The variable overhead rate variance is:<br>A)$820 F<br>B)$820

Q92: (Ignore income taxes in this problem. )

Q120: Product L28N has been considered a drag