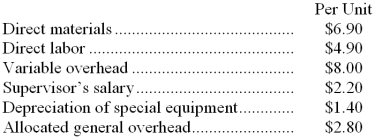

Kleffman Corporation is presently making part X31 that is used in one of its products. A total of 2,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to produce and sell the part to the company for $23.40 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $1,000 of these allocated general overhead costs would be avoided.

-If management decides to buy part X31 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

Definitions:

Cognitive-Behavioral Psychologist

A mental health professional specializing in cognitive-behavioral therapy, which focuses on identifying and changing negative thoughts and behaviors.

Histrionic

A personality disorder characterized by excessive emotionality and attention-seeking behavior.

Narcissistic

Relating to narcissism, which is characterized by an excessive interest in or admiration of oneself and one's physical appearance, coupled with a lack of empathy for others.

Psychotherapy

A therapeutic treatment involving psychological techniques designed to assist individuals in overcoming difficulties and achieving personal growth.

Q1: The nurse is reviewing the care plan

Q2: Using the least-squares regression method,the estimate of

Q11: (Ignore income taxes in this problem. )

Q14: Kane Company is in the process of

Q21: A client presents to the primary care

Q25: Ignoring the annual benefit,to the nearest whole

Q30: Manning Co.manufactures and sells trophies for winners

Q33: How much Logistics Department cost should be

Q71: In addition to the facts given above,assume

Q145: A labor efficiency variance resulting from the