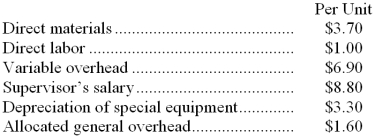

Libbee Corporation is presently making part I50 that is used in one of its products. A total of 8,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $24.50 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

An outside supplier has offered to produce and sell the part to the company for $24.50 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

-In addition to the facts given above, assume that the space used to produce part I50 could be used to make more of one of the company's other products, generating an additional segment margin of $24,000 per year for that product. What would be the impact on the company's overall net operating income of buying part I50 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Q14: The nurse is teaching the parents of

Q16: A sunk cost is a cost that

Q25: Ignoring the annual benefit,to the nearest whole

Q27: The nurse is planning a smoking cessation

Q32: Mattern Corporation applies manufacturing overhead to products

Q33: Brownell Inc.currently has annual cash revenues of

Q33: A balanced scorecard is an integrated set

Q79: The contribution margin of the West business

Q126: Rodenberger Corporation keeps careful track of the

Q149: The following data have been provided by