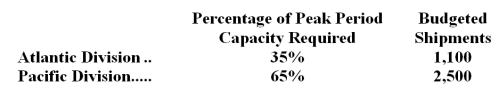

Bunyard Corporation has two operating divisions-an Atlantic Division and a Pacific Division.The company's Logistics Department services both divisions.The variable costs of the Logistics Department are budgeted at $45 per shipment.The Logistics Department's fixed costs are budgeted at $212,400 for the year.The fixed costs of the Logistics Department are determined based on peak-period demand.  At the end of the year,actual Logistics Department variable costs totaled $202,400 and fixed costs totaled $223,900.The Atlantic Division had a total of 2,100 shipments and the Pacific Division had a total of 2,300 shipments for the year.How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

At the end of the year,actual Logistics Department variable costs totaled $202,400 and fixed costs totaled $223,900.The Atlantic Division had a total of 2,100 shipments and the Pacific Division had a total of 2,300 shipments for the year.How much Logistics Department cost should be charged to the Pacific Division at the end of the year for performance evaluation purposes?

Definitions:

Inventory Valuation

The determination of the value of a company's inventory using specific methods, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), affecting financial statements.

FIFO Method

An inventory valuation method that assumes items purchased first are sold first, affecting the costs of goods sold and ending inventory.

Conversion Activity

The process of converting raw materials into finished goods through labor and manufacturing operations.

Equivalent Units

A concept used in process costing that converts partially completed units into a smaller number of fully completed units to simplify cost calculations.

Q9: The nurse is evaluating the plan of

Q9: Manchester Corporation would like to determine the

Q13: The management of Smoots Corporation would like

Q17: Leeth Corporation is considering the following six

Q22: Szafran Corporation's Maintenance Department provides services to

Q69: From the standpoint of the entire company,if

Q78: The total standard cost for direct labor

Q109: The payback period of this investment is

Q116: (Ignore income taxes in this problem. )

Q149: The following data have been provided by