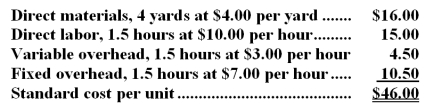

The Moore Company produces and sells a single product.A standard cost card for the product follows:

Standard Cost Card--per unit of product:  The company manufactured and sold 18,000 units of product during the year.A total of 70,200 yards of material was purchased during the year at cost of $4.20 per yard.All of this material was used to manufacture the 18,000 units.The company records showed no beginning or ending inventories for the year.

The company manufactured and sold 18,000 units of product during the year.A total of 70,200 yards of material was purchased during the year at cost of $4.20 per yard.All of this material was used to manufacture the 18,000 units.The company records showed no beginning or ending inventories for the year.

The company worked 29,250 direct labor-hours during the year at a cost of $9.75 per hour.Overhead cost is applied to products on the basis of standard direct labor-hours.The denominator activity level (direct labor-hours) was 22,500 hours.Budgeted fixed manufacturing overhead costs as shown on the flexible budget were $157,500,while actual fixed manufacturing overhead costs were $156,000.Actual variable overhead costs were $90,000.

Required:

a.Compute the direct materials price and quantity variances for the year.

b.Compute the direct labor rate and efficiency variances for the year.

c.Compute the variable overhead rate and efficiency variances for the year.

d.Compute the fixed manufacturing overhead budget and volume variances for the year.

Definitions:

Promissory Notes

Written promises to pay a specified sum of money to a named party on demand or at a determined future date.

Carrying Amount

The book value of assets and liabilities reported on the balance sheet, calculated as the original cost less any depreciation, amortization, or impairment costs.

Interest-Bearing

Referring to a financial instrument or account that generates interest income over time.

Promissory Note

A financial instrument that represents a written promise by one party to pay a specified sum of money to another party, either on demand or at a predetermined future date.

Q13: The division's margin is closest to:<br>A)44.6%<br>B)26.7%<br>C)35.2%<br>D)9.4%

Q20: The activity variance for personnel expenses in

Q33: A balanced scorecard is an integrated set

Q64: Lounsberry Inc.regularly uses material O55P and currently

Q69: The internal rate of return of the

Q85: Govoni Corporation is a specialty component manufacturer

Q106: (Ignore income taxes in this problem. )

Q120: Ignoring the cash inflows,to the nearest whole

Q120: Product L28N has been considered a drag

Q125: What is the variable overhead rate variance