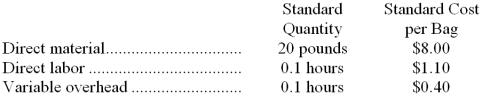

Cole laboratories makes and sells a lawn fertilizer called Fastgro. The company has developed standard costs for one bag of Fastgro as follows:  The company had no beginning inventories of any kind on Jan. 1. Variable overhead is applied to production on the basis of standard direct labor-hours. During January, the following activity was recorded by the company:

The company had no beginning inventories of any kind on Jan. 1. Variable overhead is applied to production on the basis of standard direct labor-hours. During January, the following activity was recorded by the company:

Production of Fastgro: 4,000 bags

Direct materials purchased: 85,000 pounds at a cost of $32,300

Direct labor worked: 390 hours at a cost of $4,875

Variable overhead incurred: $1,475

Inventory of direct materials on Jan. 31: 3,000 pounds

-The total variance (both rate and efficiency) for variable overhead for January is:

Definitions:

After-Tax Discount Rate

This is the discount rate that has been adjusted to reflect the impact of taxes on a project's cash flow.

Income Tax Rate

The percentage at which an individual or corporation is taxed; the rate may vary by income level, type of income, or other factors.

Working Capital

The distinction between a firm's current assets and its current liabilities, revealing the company's short-term financial health.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal installments.

Q14: If the denominator level of activity is

Q16: Nichnols Corporation's marketing manager believes that every

Q28: The revenue and spending variances are the

Q39: Rosiek Corporation uses part A55 in one

Q59: The division's return on investment (ROI) is

Q64: Relative profitability is concerned with ranking business

Q67: At Overland Company,maintenance cost is exclusively a

Q74: Plikerd Corporation has provided the following data

Q75: Heaslet Fabrication is a division of a

Q138: The overall revenue and spending variance (i.e.