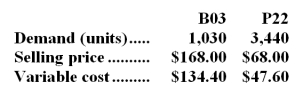

The constraint at Angstadt Inc.is a key raw material.A total of 9,700 ounces of this constrained resource are available.Data concerning the company's two products,B03 and P22,appear below:  Each unit of product B03 requires 6 ounces of the constrained raw material;each unit of product P22 requires 2 ounces.

Each unit of product B03 requires 6 ounces of the constrained raw material;each unit of product P22 requires 2 ounces.

Required:

a.In the present circumstances,which product is most profitable?

b.How much of each product should be produced?

c.The company is considering launching a new product whose variable cost is $158 and that requires 14 ounces of the constrained resource.What is the minimum acceptable selling price for the new product?

Definitions:

Variable-Rate Loan

A loan where the interest rate can change, based on an underlying benchmark or index that reflects the cost to the lender of borrowing on the credit markets.

Increases In Interest Rates

A scenario where central banks or financial institutions decide to raise the cost of borrowing money.

Cap

An upper limit set on the amount of money that can be charged or paid in a certain situation, such as interest rates on a loan or fees.

Cross-Hedging

Cross-hedging involves using a hedge to manage risk by investing in a financial instrument that is not directly correlated to the underlying asset but has similar price movements.

Q8: Ferro Wares is a division of a

Q10: A favorable materials price variance coupled with

Q18: Mackessy Corporation applies manufacturing overhead to products

Q22: Posson Catering uses two measures of activity,jobs

Q37: The fixed manufacturing overhead volume variance is

Q44: The contribution margin of the Commercial business

Q47: The fixed manufacturing overhead budget variance and

Q60: The markup percentage needed on Product S

Q128: Superior Industries' sales budget shows quarterly sales

Q197: The direct materials in the flexible budget