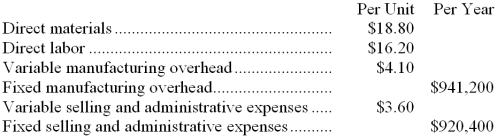

Diehl Company makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 52,000 units per year.

The company has invested $420,000 in this product and expects a return on investment of 8%.

Direct labor is a variable cost in this company.

-If every 10% increase in price leads to an 11% decrease in quantity sold, the profit-maximizing price is closest to:

Definitions:

Cash Generating Units

A segment of a company's operations that independently generates cash flows from its activities.

Carrying Amount

The amount at which an asset is recognized in the balance sheet after deducting any accumulated depreciation (amortization) and accumulated impairment losses.

Value In Use

The value today of the cash flows that are expected to come from an asset or a revenue-producing entity in the future.

Impairment Loss

A reduction in the recoverable value of an asset below its carrying amount on the balance sheet, recognized as a loss.

Q1: For the past year,the turnover was:<br>A)25<br>B)10<br>C)4<br>D)2

Q1: Purchase order processing is an example of

Q11: A planning budget is prepared before the

Q14: Which of the following would be the

Q20: The activity variance for personnel expenses in

Q25: Up to how much should the company

Q58: Retained earnings at the end of December

Q94: The cash budget must be prepared before

Q158: The direct materials in the flexible budget

Q286: The expendables in the flexible budget for