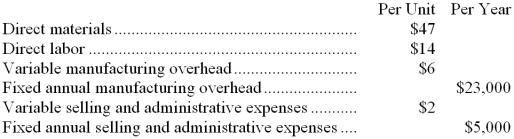

The management of Matsuura Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%.

Management plans to produce and sell 1,000 units of the new product annually. The new product would require an investment of $254,000 and has a required return on investment of 10%.

-The unit target selling price using the absorption costing approach is closest to:

Definitions:

Tax Expense

The amount of taxation a company is required to pay to various tax authorities, based on its earnings.

SUTA Tax Payable

The liability owed by employers to the state for the State Unemployment Tax Act, used to fund unemployment benefits.

Payroll Tax Expense

Payroll Tax Expense is the employer's cost associated with the employment of staff, including taxes such as social security and Medicare taxes that must be paid based on salaries.

Wages Payable

A liability account representing the amount owed to employees for work performed but not yet paid.

Q13: How much of the actual fixed maintenance

Q14: Kirby,Inc. ,manufactures a product with the following

Q54: Foshie Corporation is about to launch a

Q56: In a cash budget for March,the total

Q58: The activity variance for net operating income

Q143: Entler Framing's cost formula for its supplies

Q148: The activity variance for net operating income

Q171: The spending variance for materials and supplies

Q179: A flexible budget is an estimate of

Q187: Dunklin Medical Clinic measures its activity in