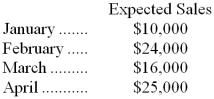

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below.  The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) . All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-The Accounts Receivable balance that would appear in the March 31 budgeted balance sheet would be:

Definitions:

Globalization Strategy

A globalization strategy is an approach adopted by organizations intending to operate and compete on a global scale, often involving diversifying markets, sourcing, and product offerings internationally.

Global Strategy

A plan developed by an organization to operate and compete in international markets.

Q19: In the absence of a constraint,all business

Q20: Paulson Company uses a predetermined overhead rate

Q25: Changing a cost accounting system is likely

Q32: The following is last month's contribution format

Q36: Darter Company manufactures two products,Product F and

Q37: Up to how much should the company

Q62: Coggin Inc.uses a job-order costing system in

Q104: In June the company has budgeted to

Q108: Epperson Inc. ,which uses job-order costing,has provided

Q118: Under absorption costing,the unit product cost is:<br>A)$24<br>B)$20<br>C)$26<br>D)$29