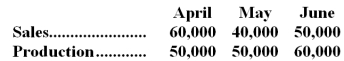

Carter Company has projected sales and production in units for the second quarter of next year as follows:

Required:

a.Cash production costs are budgeted at $6 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses (all of which are paid in cash) amount to $120,000 per month.The accounts payable balance on March 31 totals $192,000,all of which will be paid in April.Prepare a schedule for each month showing budgeted cash disbursements for Carter Company.

b.Assume that all units will be sold on account for $15 each.Cash collections from sales are budgeted at 60% in the month of sale,30% in the month following the month of sale,and the remaining 10% in the second month following the month of sale.Accounts receivable on March 31 totaled $510,000 $(90,000 from February's sales and the remainder from March).Prepare a schedule for each month showing budgeted cash receipts for Carter Company.

Definitions:

Unit Product Cost

The total cost (direct materials, direct labor, and manufacturing overhead) divided by the number of units produced.

Machine-Hours

Machine-hours represent a measure of production time, indicating the total hours a machine is operated in the manufacturing process of goods.

Variable Manufacturing Overhead

Costs that vary with the level of production output and are related to manufacturing the product but not directly traceable to specific units of product.

Job J

Likely a specific reference to a job or project within a company, requiring a definition based on its context.

Q12: What is the budgeted accounts receivable balance

Q42: The direct labor in the planning budget

Q60: When combining activities in an activity-based costing

Q67: Profits move in the same direction as

Q68: The use of predetermined overhead rates in

Q110: Borys Inc. ,which uses job-order costing,has provided

Q121: What is the net operating income for

Q142: The activity variance for selling and administrative

Q146: The company's break-even in unit sales is

Q192: Valesquez Corporation's operating leverage is 8.6.If the