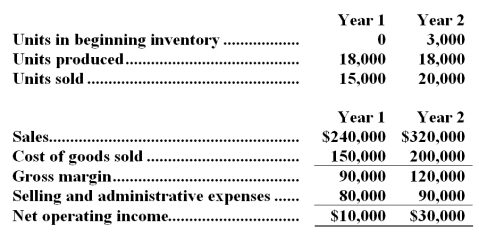

Fowler Company manufactures a single product.Operating data for the company and its absorption costing income statements for the last two years are presented below:  Variable manufacturing costs are $6 per unit.Fixed manufacturing overhead totals $72,000 in each year.This overhead is applied at the rate of $4 per unit.Variable selling and administrative expenses are $2 per unit sold.

Variable manufacturing costs are $6 per unit.Fixed manufacturing overhead totals $72,000 in each year.This overhead is applied at the rate of $4 per unit.Variable selling and administrative expenses are $2 per unit sold.

Required:

a.What was the unit product cost in each year under variable costing?

b.Prepare new income statements for each year using variable costing.

c.Reconcile the absorption costing and variable costing net operating income for each year.

Definitions:

Earnings Per Share

A company's profit divided by its number of outstanding shares of common stock, indicating the profitability available to shareholders on a per-share basis.

Current Ratio

A financial metric assessing a firm's capacity to meet its short-term debts due within a year, determined by dividing its current assets by its current liabilities.

Company

A legal entity formed by a group of individuals to engage in and operate a business enterprise.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term financial health and operational efficiency of the business.

Q5: The overhead for the year was:<br>A)$2,994 underapplied<br>B)$2,444

Q22: The cost of goods sold that would

Q26: What was the absorption costing net operating

Q34: Mcintee Inc. ,which uses job-order costing,has provided

Q42: The cost of goods sold that appears

Q71: This question is to be considered independently

Q79: Scobie Corporation's fixed monthly expenses are $16,000

Q88: Fuquay Corporation uses customers served as its

Q101: Deviney Corporation is working on its direct

Q284: Bures Jeep Tours operates jeep tours in