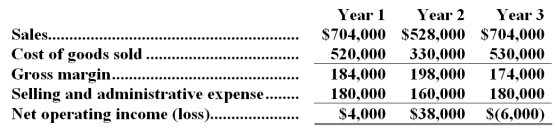

The Hadfield Company manufactures and sells a unique electronic part.The company's plant is highly automated with low variable and high fixed manufacturing costs.Operating results on an absorption costing basis for the first three years of activity were as follows:  Additional information about the company is as follows:

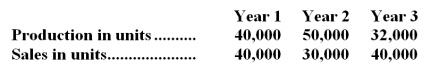

Additional information about the company is as follows:

- Variable manufacturing costs (direct labor,direct materials,and variable manufacturing overhead) total $3 per unit,and fixed manufacturing overhead costs total $400,000.

- Fixed manufacturing costs are applied to units of product on the basis of the number of units produced each year (i.e. ,a new fixed manufacturing overhead rate is computed each year).

- The company uses a FIFO inventory flow assumption.

- Variable selling and administrative expenses are $2 per unit sold.Fixed selling and administrative expenses total $100,000.

- Production and sales information for the three years is as follows:  Required:

Required:

a.Compute net operating income for each year under the variable costing approach.

b.Referring to the absorption costing income statements above,explain why net operating income was higher in Year 2 than in Year 1 under absorption costing,in light of the fact that fewer units were sold in Year 2 than in Year 1.

c.Referring again to the absorption costing income statements,explain why the company suffered a loss in Year 3 but reported a profit in Year 1,although the same number of units was sold in each year.

d.If the company had used lean production during Year 2 and Year 3 and produced only what could be sold,what would the company's net operating income (loss) have been each year under absorption costing?

Definitions:

Q38: In activity-based costing,as in traditional costing systems,nonmanufacturing

Q57: The contribution margin ratio is closest to:<br>A)47.1%<br>B)2.1%<br>C)1.9%<br>D)52.9%

Q85: Which of the following companies would be

Q111: What is the company's break-even in units?<br>A)20,000

Q128: All other things equal,the margin of safety

Q129: Net operating income computed using variable costing

Q196: The management of Reagon Corporation expects sales

Q218: Cotillo Corporation uses customers served as its

Q273: The administrative expenses in the planning budget

Q291: During October,Moceri Clinic budgeted for 3,000 patient-visits,but