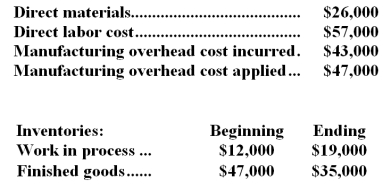

Bruni Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed out to cost of goods sold at the end of the month.The company has provided the following data for February:

-The cost of goods manufactured for February is closest to:

Definitions:

Taxable Income

The amount of income that is used to calculate an individual or a corporation's income tax due, after all deductions and exemptions.

Federal Unemployment Compensation

Financial assistance provided by the federal government to individuals who have lost their jobs.

Marginal Tax Rate

The rate at which the last dollar of a taxpayer's income is taxed, indicating the tax rate that applies to each additional dollar of taxable income.

Average Tax Rate

The percentage of total taxable income that is paid in taxes, calculated by dividing the total tax paid by the total taxable income.

Q6: What is the net operating income for

Q13: Bell Company has provided the following data

Q55: A manufacturing company that produces a single

Q63: A production budget is to a manufacturing

Q90: Roberts Company produces a single product.During the

Q92: The budgeted net income for November is:<br>A)$50,000<br>B)$68,000<br>C)$75,000<br>D)$135,000

Q98: Snappy's manufacturing overhead for the year was:<br>A)$10,250

Q106: What is the net operating income for

Q117: Mulvehill Clinic bases its budgets on the

Q174: Witczak Company has a single product and