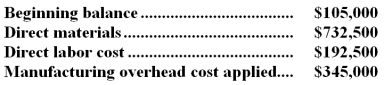

Lewis Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In October the company completed job P70C that consisted of 25,000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job P70C shows the following costs:  During the month,the actual manufacturing overhead cost incurred was $334,500 and 13,000 completed units from job P70C were sold.No other products were sold during the month.

During the month,the actual manufacturing overhead cost incurred was $334,500 and 13,000 completed units from job P70C were sold.No other products were sold during the month.

-The cost of goods sold that would appear on the income statement for October,after adjustment for any underapplied or overapplied overhead,is closest to:

Definitions:

Closing Entries

Entries made in the accounting records at the end of an accounting period to prepare the accounts for the next period.

Journalized

The process of recording transactions in the journal, the first step in the accounting cycle.

Interim Accounting Period

A financial reporting period that is shorter than a full fiscal year, often quarterly or monthly.

Financial Statements

Reports that summarize the financial performance, position, and cash flows of a business over a specific period.

Q1: Mauffray Inc.uses a job-order costing system in

Q24: The best estimate of the total monthly

Q41: To the nearest whole dollar,what should be

Q54: This question is to be considered independently

Q92: The cost of goods manufactured for August

Q104: If Buffo plans to produce and sell

Q114: A contribution approach income statement can usually

Q124: Akerley,Inc. ,produces and sells a single product.The

Q190: The break-even in monthly unit sales is

Q233: Novielli Corporation bases its budgets on the