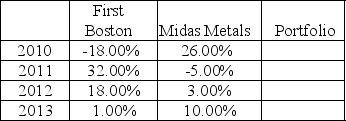

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a.Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b.Compute the standard deviation for each stock and the portfolio.

c.Are the stocks positively or negatively correlated and what is the effect on risk?

Definitions:

Back to Abdomen

A position or orientation; often refers to the position of a fetus during pregnancy where the baby's backbone is aligned towards the mother's abdomen.

Bang Objects

Striking items forcefully against another surface to create a loud noise or to fixate them in place.

Busy Box

A variety of engaging activities or sensory toys assembled in a box, used to keep young children or patients with dementia busy and stimulated.

Electronic Games

Games that are played using electronic devices with visual and auditory feedback.

Q23: Futures contracts for various commodities have different

Q23: A stock's value depends on future cash

Q30: Small investors normally have a negotiated commission

Q36: The definition of commodity is broad enough

Q89: Stocks held in street name can be

Q90: The great majority of transactions on the

Q102: The dividend valuation model estimates the value

Q103: A limit order is an order to

Q111: In spite of major losses in 2008,

Q112: The current price of XUM stock is