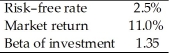

You have gathered the following information concerning a particular investment and conditions in the market.  According to the Capital Asset Pricing Model, the required return for this investment is

According to the Capital Asset Pricing Model, the required return for this investment is

Definitions:

Percentiles

A measure that indicates the value below which a given percentage of observations in a group of observations falls.

Stanines

Derived from the term “standard nines,” this is a standardized score frequently used in schools. Often used with achievement tests, stanines have a mean of 5 and a standard deviation of 2, and range from 1 to 9.

T-scores

Standardized scores with a mean of 50 and a standard deviation of 10, used to compare an individual's score against a normative sample.

Grade Equivalents

A metric used in education to compare a student's test score with the average scores of students in other grades.

Q8: From March 2009 to January 2012, stock

Q8: The Sarbanes-Oxley Act of 2002 strengthens accounting

Q25: A stock's beta value is a measure

Q27: Which one of the following will provide

Q38: High P/E ratios can be expected when

Q52: Return on equity (ROE)is computed by dividing

Q63: John requires a 12% rate of return

Q67: The new highs-new lows measure typically looks

Q86: Which one of the following statements is

Q118: The three steps in determining a stock's