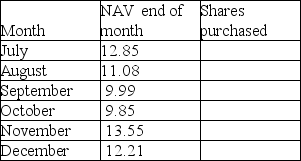

Net asset values at the end of each month for the no-load Currier & Ives fund are shown below.Holly Tannenbaum invests $500 in the fund each month through an automatic investment plan.Compute:

a.the number of shares purchased each month

b.the number of shares she owns at the end of December

c.the average price of the shares over the period

d.the average price per share paid by Holly

Definitions:

Cost of Capital

The vital rate of earnings a company must generate from its investment plans to preserve its standing in the market and appeal for investments.

Treasury Bills

Short-term government securities with maturities ranging from a few days to 52 weeks, sold at a discount from their face value.

Financial Option

A contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price.

Fixed Price

An agreed upon price for goods and services that remains constant, unaffected by the fluctuations in the market or resource costs.

Q2: Yield to call on a bond with

Q14: Assume a portfolio manager created a short

Q18: Which of the following risks are included

Q28: The various CMO tranches can have significantly

Q44: Dividends and capital gains earned by mutual

Q59: Alan just bought 100 shares of Global,

Q59: Tax planning<br>A)guides investment activities to maximize after-tax

Q85: An increase in the market rate of

Q105: The margin deposit associated with the purchase

Q110: In general, foreign-pay bonds provide _ rates