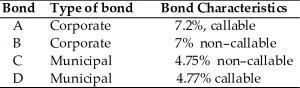

Martin is trying to decide which one of the following bonds he should purchase.All the bonds have the same maturity date and all have approximately the same level of risk.The general level of interest rates is declining.Martin is in the 33 percent federal income tax bracket and the 6 percent state income tax bracket.The municipal bonds are from his home state.  Which bond should Martin purchase if he wishes to hold it for the long term?

Which bond should Martin purchase if he wishes to hold it for the long term?

Definitions:

Entrepreneur

An individual who organizes and operates a business or businesses, taking on greater than normal financial risks in order to do so.

Entrepreneurs

Individuals who create, launch, and manage new businesses, often taking on considerable risk in the expectation of profit.

Bankruptcy

A legal process involving a person or business that is unable to repay outstanding debts, resulting in the distribution of assets to creditors.

Equity Financing

Exchanging ownership shares for outside investment monies.

Q13: Taxes are reduced by $70 billion and

Q35: A fund that is designed to match

Q41: A bond matures in 30 years, has

Q75: Refer to Figure 9.5.If the economy is

Q76: Warehousing liquidity protects a portion of the

Q83: Which of the following risks can be

Q107: Assuming no government or foreign sector,the formula

Q109: If unplanned inventory investment is positive,then<br>A)planned investment

Q131: What is the difference between a naked

Q170: Refer to Table 8.4.Which of the following