4.2 Supply and Demand Analysis: An Oil Import Fee

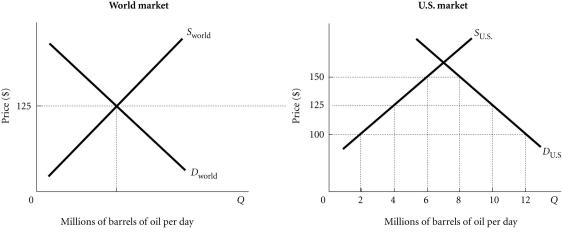

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. If the United States levies no taxes on imported oil, which of the following would occur?

Definitions:

Work In Process Inventory

Work In Process Inventory consists of partially completed goods that are still in production, representing a component of a manufacturing company's inventory.

Balance Sheet

A financial statement that summarizes a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a snapshot of its financial condition.

Indirect Labor

Labor costs not directly associated with the production of goods or services, such as salaries of supervisors and maintenance staff.

Shop Foreman's Salary

The compensation paid to the individual responsible for overseeing the work and workers in a shop or factory setting.

Q8: In figure 4.6 at equilibrium,consumer surplus is

Q14: The government imposes a maximum price on

Q35: The price of one country's currency in

Q38: In 2006,the literacy rate of people over

Q49: The total of consumer plus producer surplus

Q62: Stock market transactions are part of GNP.

Q80: If the price index in 2011 is

Q82: Unemployment generally _ during recessions and _

Q91: Remittances can be used as investment capital

Q97: Hyperinflation and stagflation are two different names