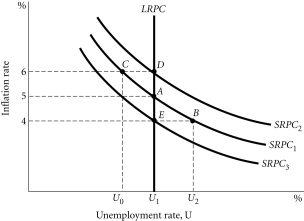

Refer to the information provided in Figure 14.7 below to answer the questions that follow.

Figure 14.7

Figure 14.7

-Refer to Figure 14.7.If the economy is at Point B,the cost of raw material decreased dramatically,and the aggregate demand did not change,the economy could move to Point

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of an additional dollar of earnings that will be paid in tax.

Average Tax Rate

The average tax rate is the portion of total income that is paid as taxes, calculated by dividing the total taxes paid by the total income.

State Tax Revenue

The income that a state government receives from taxation of individuals and businesses within its jurisdiction.

Federal Spending

Federal spending refers to the government's expenditure on goods, services, and public projects, financed by taxes and borrowing.

Q17: If money demand falls,then the interest rate

Q33: The price of bonds and the interest

Q35: Refer to Figure 13.2.In response to a

Q62: Refer to Figure 13.1.An aggregate demand shift

Q94: An unexpected increase in inventories has a

Q116: The transaction demand for money depends on

Q120: The enacted Gramm-Rudman-Hollings Act would tend to

Q136: The path of consumption over a lifetime

Q163: If the income effect is greater than

Q165: Productivity fluctuates along a business cycle because<br>A)firms