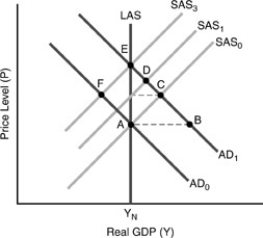

Figure 17-3

-In the figure above, suppose we are working under the assumption of the Lucas model. The Fed has been following an announced policy of "zero money growth for an indefinite period." Suddenly and without warning it produces positive money growth and a "money surprise." This would result in a movement between points

Definitions:

Semistrong Form

States that current market prices reflect all publicly available information. Therefore, the only way to gain abnormal returns on a stock is to possess inside information about the company’s stock.

Stock Market Efficiency

The concept that all available information is reflected in stock prices, thus making it impossible to consistently achieve higher returns than the overall market.

Nonconstant Growth Model

A valuation approach for stocks that assumes a company's dividends will grow at different rates in different periods, unlike the constant growth model.

Initial Growth Period

The phase in a business or project's life cycle characterized by a rapid expansion in revenue and customer base, often necessitating significant investment in marketing and capacity.

Q10: The key data in the purchasing view

Q18: The four most common material types are

Q22: The use of bar codes, computerized price

Q25: A customer info record is an intersection

Q26: In the Friedman "Fooling Model" a _

Q27: Transaction data reflect the consequences of executing

Q36: During the _ output _ its natural

Q81: Suppose a worker signs a contract containing

Q108: Evidence from the United States and Japan

Q139: Assuming that workers will be pushed off