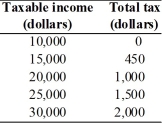

-The table above gives the taxable income and the amount of tax paid.

a.Is this income tax progressive,regressive,or proportional?

b.If the taxable income is $25,000,what is the average tax rate?

c.If taxable income increases from $25,000 to $30,000,what is the marginal tax rate?

Definitions:

Qualified Education Expenses

These are costs such as tuition and fees required for enrollment or attendance at an eligible educational institution, and course-related expenses.

Deductible Student Loan Interest

Interest paid on a qualified student loan, which may be deductible, reducing the taxable income of the payer.

Tuition And Fees

Charges associated with enrollment and attendance at educational institutions, including costs for classes, administration, and sometimes room and board.

High Deductible Health Plan

A High Deductible Health Plan (HDHP) is a health insurance plan with lower premiums and higher deductibles than a traditional health plan, often linked to Health Savings Accounts (HSAs).

Q26: The 2010 health care reform that expanded

Q29: The national security argument is used by

Q32: What is the difference between vertical equity

Q48: The sales tax in Dutchess County,New York,is

Q127: If a nation imports a good that

Q161: In the labor market shown in the

Q183: What is rent seeking with respect to

Q192: Which of the following is the national

Q226: The figure above shows the labor market

Q258: If the United States imposes a tariff