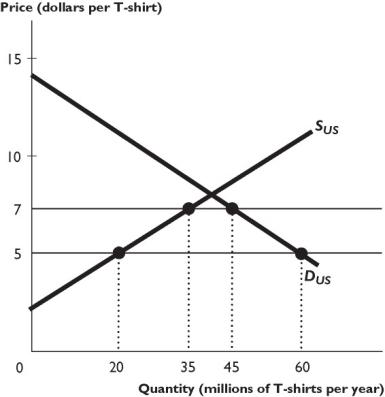

The figure above shows the U.S. market for T-shirts, where SUS is the domestic supply curve and DUS is the domestic demand curve. The world price of a T-shirt is $5. The U.S. government imposes a $2 per unit tariff on imported T-shirts.

-The figure above shows that as a result of the tariff,the quantity of T-shirts produced in the United States ________,and the quantity of T-shirts imported ________.

Definitions:

Installment Note

A debt instrument that requires a series of periodic payments, often including both principal and interest, over a set period of time.

Carrying Amount

The value of an asset or liability as reported in a company's financial statements, reflecting adjustments like depreciation or amortization.

Installment Note

A loan that is repaid over time with a set number of scheduled payments.

Carrying Amount

The book value of assets and liabilities as recorded in the financial statements, reflecting historical costs adjusted for depreciation, amortization, and impairment.

Q53: Dumping is defined as the situation in

Q100: Which of the following goods is excludable

Q150: The table above has the domestic demand

Q152: The figure above shows the market for

Q173: If an external benefit is present in

Q175: The marginal benefit of a public good

Q181: The figure above shows the costs and

Q237: The table above gives the domestic demand

Q254: If the marginal private cost of running

Q270: Sales taxes are usually collected from sellers,who