Assume consumption is represented by the following: C = 200 + .9Y. Also assume that planned investment (I) equals 300.

(a) Now, suppose the level of income is equal to 4000. What is the level of planned aggregate expenditures at this level of income?What is the value of any unplanned changes in inventories?

(b) Given the information, calculate the equilibrium level of income.

(c) Given the information, calculate the level of consumption and saving that occurs at the equilibrium level of income.

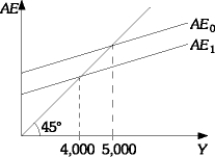

(d) Suppose planned investment falls by 100. Graphically illustrate using the AE - Y graph the effects of this reduction in planned investment on the economy. Also, calculate the new level of equilibrium income.

(a) AE = 200 + .9(4000) + 300 = 4100. Unplanned changes in inventories equal

(b) Y = 5000

(c) C = 4700 and S = 300

(d) Y = 4000

Definitions:

Dow Average

A stock market index that represents the stock performance of 30 large, publicly-owned companies based in the United States.

Four-Factor Model

An investment model that extends the three-factor model by adding momentum as a factor to account for stock performance.

Excess Returns

The return on an investment beyond the return expected from the risk level, often compared to benchmarks or risk-free returns.

Fama and French

A model developed by Eugene Fama and Kenneth French that expands on the Capital Asset Pricing Model (CAPM) by adding size risk and value risk factors to the market risk factor.

Q3: Suppose you want to earn a 7%

Q6: What do economists mean by the concept

Q10: How do corporate bonds differ from corporate

Q16: What is a Treasury bill?

Q22: Provide three reasons why open market operations

Q43: Explain the factor type that is important

Q49: If Bob makes a deposit of $1000

Q63: It is best to avoid the use

Q74: Write out the equation for calculating personal

Q83: Using Table 6.1 calculate the percentage increase