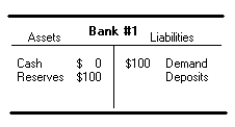

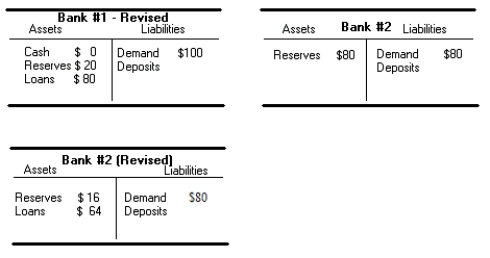

Assume that a banking system starts from scratch with the following characteristics. The first bank has $100 in cash deposits which automatically count as reserves. The banking system has a required reserve ratio of 20% and all banks must lend out their excess reserves. Additionally, a check must be drawn in the full amount of the loan and deposited with another bank. Draw the modified balance sheet for Bank #1 and the balance sheet of the second bank in the process and show what happens to loan creation, reserves and demand deposits. Explain what should happen to the second bank. Below is the balance sheet for Bank #1:

Definitions:

Limited

Restricted in size, amount, or extent; lesser in scope or application.

Coppertone Products

A brand known for its sun protection and skin care products, including sunscreens and lotions.

Postpurchase Behavior

The actions and reactions of consumers after buying a product or service, including their levels of satisfaction, loyalty, and likelihood of repeat purchases.

Dissatisfaction

The feeling of unhappiness or disappointment resulting from the disparity between one’s expectations and the actual performance or outcome.

Q4: Assume the Bank of Smithville opens its

Q7: Explain why changes in the goods market

Q14: Why would it be futile for a

Q20: Define stagflation and explain why it undermined

Q39: Explain the trade-off between holding bonds and

Q46: Figure 28.1 depicts a short-run aggregate supply

Q51: Explain the speculative motive for holding money.

Q71: Using the graph above, provide three reasons

Q77: What is the federal funds rate? What

Q81: Explain what is meant by the income