Table 27.1

Table 27.1

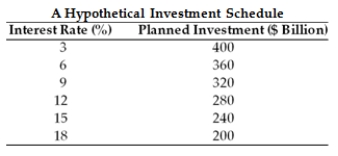

-Use the Table 27.1 to answer the following question. Suppose the expenditure multiplier is 5 and the initial interest rate is 12%. Where will the interest rate have to move to in order to cause equilibrium output to fall by 400 billion?

Definitions:

Intrinsic Value

The inherent or true value of a security, based on underlying assets and earnings, independent of its market value.

Dividends

Payments made by a corporation to its shareholder members, typically derived from the company's profits.

ROE

Return on Equity, a measure of financial performance calculated by dividing net income by shareholders' equity, indicating how effectively management is using a company’s assets to create profits.

Dividend Growth Rate

The annualized percentage rate of growth of a company's dividend payments to shareholders.

Q23: Suppose an economy is initially in equilibrium

Q26: Assume that the government spending multiplier is

Q38: What do the authors of the text

Q53: Explain why persisten inflation can have a

Q58: Explain the balanced budget multiplier.

Q66: Why might the general public in a

Q67: Using the above table, calculate the value

Q71: Using the graph above, provide three reasons

Q85: If aggregate demand increases and expectations regarding

Q87: Explain the money creation process.