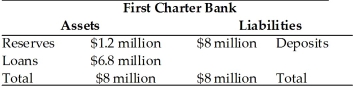

Refer to the information provided in Table 10.4 below to answer the questions that follow.

Table 10.4

-Refer to Table 10.4. If the required reserve ratio were changed to 5% and First Charter Bank continues to hold $1,200,000 in reserves, its excess reserves will be

Definitions:

Straight Bond Value

The present value of a bond's future interest payments and its principal amount at maturity, assuming it does not have any embedded options.

Intrinsic Value

The actual, inherent value of a financial asset, determined through fundamental analysis without reference to its market value.

American Call Option

An option contract that gives the holder the right, but not the obligation, to buy a specified amount of an underlying asset at a predetermined price before or on a specified date.

Exercise Price

The predetermined cost at which the owner of an option can purchase (in the case of a call option) or sell (in the case of a put option) the underlying asset or commodity.

Q41: In a binding situation, changes in government

Q46: If government spending is increased by $500,

Q61: A cost shock, such as a natural

Q93: Refer to Table 10.7. Great Gazoo Bank's

Q147: Among the members of the Federal Open

Q151: The level of aggregate output demanded falls

Q200: Refer to Figure 11.8. If the economy

Q205: The aggregate supply curve shows the relationship

Q206: Refer to Figure 11.6. Suppose the equilibrium

Q260: If government spending is increased by $300,