Refer to the information provided in Scenario 10.2 below to answer the questions that follow.

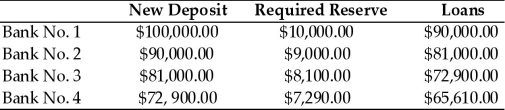

SCENARIO 10.2: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up.

-Refer to Scenario 10.2. If the required reserve ratio were changed to 20%, total loans of Bank No. 2 will change to

Definitions:

Percentage of Sales Approach

A financial planning model that estimates changes in balance sheet and income statement items as a direct percentage of changes in sales.

Financial Planning Method

A systematic approach to setting financial goals, developing and implementing plans to achieve those goals, and monitoring progress.

Predicted Sales

Forecasted revenue from goods or services sold over a future period, based on current trends or analyses.

Sales Dilution Approach

A method used in finance to estimate the impact of issuing new shares on the earnings per share by assuming no increase in sales.

Q3: Demand-pull inflation and cost-push inflation both lead

Q12: Refer to Table 9.4 At the equilibrium

Q86: If the tax multiplier is -9 and

Q116: A movement up the aggregate supply curve

Q122: Legal tender is<br>A) money that must be

Q146: If a bank is "loaned up," it

Q152: Refer to Figure 10.2. An increase in

Q261: Any transaction that involves exchanging one good

Q318: Refer to Figure 10.1. A movement from

Q338: Commercial banks _ through making loans.<br>A) decrease