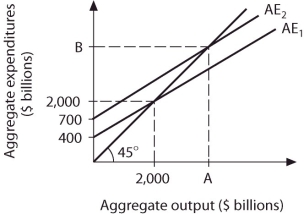

Refer to the information provided in Figure 9.4 below to answer the questions that follow.  Figure 9.4

Figure 9.4

-Refer to Figure 9.4. The value of Point B is

Definitions:

Reward-To-Variability Ratio

A ratio that compares the expected return of an investment to the risk (variability) of that investment, often used to gauge the performance of investment portfolios.

Capital Market Line

A theoretical line used in the capital asset pricing model to illustrate the risk versus return trade-off for efficient portfolios.

Risk-Free Rate

The theoretical rate of return on an investment with no risk of financial loss, typically represented by government bonds.

Standard Deviation

A statistical measure of the dispersion or variability in a dataset, commonly used in finance to measure the volatility or risk associated with a particular investment.

Q39: In 2016, the city of Miketown collected

Q42: Refer to Figure 8.2. The line segment

Q76: Refer to Table 8.7. If aggregate output

Q156: Refer to Table 9.6. The equilibrium level

Q174: As the size of the MPC decreases,

Q242: Acropolis Bank has $600 million in deposits.

Q272: Saturn County Savings and Loan has liabilities

Q293: The aggregate consumption function is C =

Q345: If planned investment exceeds actual investment,<br>A) there

Q352: Refer to Scenario 10.2. If the required