4.2 Supply and Demand Analysis: An Oil Import Fee

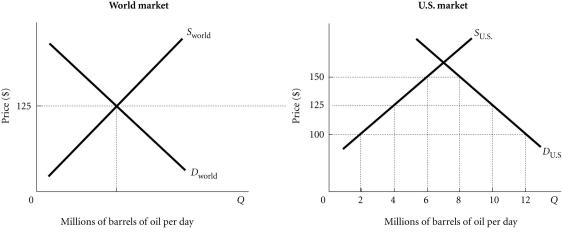

Refer to the information provided in Figure 4.4 below to answer the questions that follow.  Figure 4.4

Figure 4.4

-Refer to Figure 4.4. Assume that initially there is free trade. Tax revenue of $50 million per day will be generated if the United States imposes a ________ tax per barrel on imported oil.

Definitions:

Planning for Objections

Preparing responses to potential objections or concerns a client might raise during the sales process.

Objection Pre-Emption

A sales strategy where potential objections are anticipated and addressed before the customer raises them.

Forestalling an Objection

A sales technique involving addressing potential concerns or objections before they are explicitly raised by the customer.

True Objection

The real and underlying concern that a customer has, preventing them from completing a purchase.

Q75: Taco Bell opens a branch in Iceland.

Q77: One of the flaws of GDP is

Q89: If net investment in 2017 is $225

Q100: If in the same period output doubles

Q100: Refer to Figure 2.2. Full resource employment

Q105: According to the theory of comparative advantage,

Q128: When the supply of bubble gum increases

Q146: If price is below the equilibrium, there

Q179: If an economy is producing on its

Q201: A decrease in the overall price level