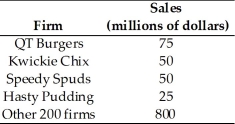

-The table above shows the revenue figures for the top four firms along with a total for the remaining firms in the fast-food industry.What is the four-firm concentration ratio for the industry?

Definitions:

AGI

Adjusted Gross Income, calculated by taking gross income and subtracting specific deductions, determining eligibility for many tax credits and deductions.

Deductibility

Deductibility pertains to the eligibility of an expense to be subtracted from gross income to lower taxable income, based on tax laws and regulations.

Medical Expenses

Costs for healthcare services that are paid out-of-pocket by an individual or covered by insurance.

Casualty Loss

A loss resulting from a sudden, unexpected, or unusual event such as a storm, theft, or car accident, which can potentially be deducted from one's taxes.

Q87: Patents<br>A) are granted only to competitive firms

Q97: If the wage rate increases,a firm's demand

Q106: The figure above shows the market demand

Q127: Which of the following represents a derived

Q137: Product differentiation means<br>A) making a product that

Q140: Ownership of a necessary input creates what

Q158: The focus of antitrust legislation is to<br>A)

Q174: When used with a natural monopoly,an average

Q218: The above figure shows the market demand

Q370: One way a company can cover its