On 1 July20X0, Abel Ltd entered into a 50:50 joint operation with Tasman Ltd to develop an oil field off the south coast of Tasmania. Each operator's initial contribution was $2 million. Abel contributed $1 million cash and equipment with a fair value of $1 million and a book value of $500 000. Tasman's contributed $2 million cash.

Additional information

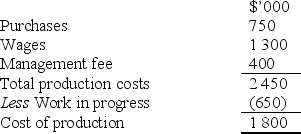

Production costs for the JO for the year ended 30 June 20X1 were:

The remaining useful life of the equipment contributed by Abel is 5 years.

Tasman is responsible for the day to day management of JO and has recognised the management fee received during the year as revenue. The costs of providing these management services to JO was $225 000.

Tasman has sold all of the oil distributed to it and Abel has sold 50% of the oil distributed to it by 30 June 20X1.

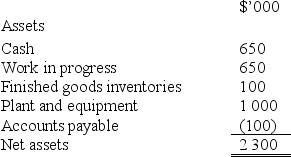

An extract of JO's balance sheet at 30 June 20X1 shows:

Which of the following will not form part of Abel Ltd's initial contribution entry?

Definitions:

Zolpidem

A medication primarily used for the short-term treatment of sleeping problems.

Imbalanced Nutrition

A condition where an individual's dietary intake does not provide the necessary nutrients for proper health and function.

Continuous Pulse Oximetry

A non-invasive method to monitor the oxygen saturation level of the blood continuously.

Postoperative Patient

A postoperative patient is an individual who is in the recovery phase following surgical procedures, requiring specific care and monitoring to ensure proper healing.

Q13: EPS refers to:<br>A) equity per share.<br>B) earnings

Q15: Which of the following is the correctly

Q19: Jiminez Limited acquired 80% of the shares

Q24: AASB 141/IAS 41 requires that biological assets

Q33: A reaction that can proceed in either

Q34: In the dehydration of an alcohol to

Q47: The pH of 0.001 M HCl is

Q57: Thiols can be gently oxidized to<br>A)disulfides.<br>B)aldehydes.<br>C)ketones.<br>D)carboxylic acids.<br>E)thioethers.

Q79: Light-induced cis-trans isomerization is an important step

Q86: Organic compounds are always highly water soluble.