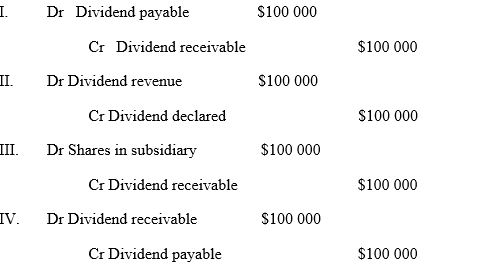

At the date of acquisition, a subsidiary had recorded a dividend payable of $100 000. Assuming that the shares were acquired on a cum div. basis, the consolidation adjustment needed at the date of acquisition to eliminate the dividend is:

Definitions:

Acquiring Firms

Companies involved in the process of buying or merging with other companies to increase their size and capabilities.

Acquisition

The process by which one company takes over the control or ownership of another company, either through direct purchase, merger, or exchange of shares.

Target Firm

A company that is the object of a takeover attempt, whether friendly or hostile, by another company or corporate entity.

Incremental Value

The additional or extra value generated by undertaking a certain action or investment.

Q1: What is the name of the medical

Q1: AASB 141/IAS 41 considers that there are

Q6: Which of the following is not one

Q6: In the number 45.678, the digit 6

Q6: Alpha Limited acquired shares in Bravo Limited.

Q8: Which of the following are regarded as

Q11: Post acquisition date retained earnings that are

Q11: There is more traffic between 8 and

Q23: Benefits paid to members of a defined

Q62: The rate of a chemical reaction is