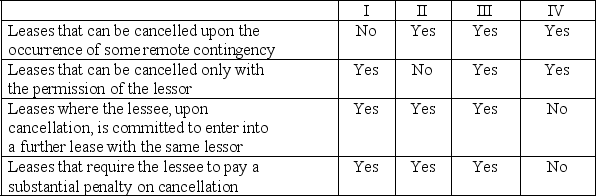

AASB 117 deems cancellable leases with which of the following characteristics to be non-cancellable:

Definitions:

Asset Impairment Test

A procedure carried out to determine if an asset's carrying amount is not recoverable and exceeds its fair value, necessitating a write-down to its fair value.

Deferred Tax Asset

A tax benefit stemming from temporary differences between accounting and tax calculations, which will result in deductible amounts in future tax payments.

Intraperiod Tax Allocation

The apportionment of tax expense or benefit among the different parts of an entity’s financial statements, such as continuing operations and discontinued operations, within the same fiscal period.

Accelerated Depreciation

A method of depreciation in which an asset loses value at a faster rate in the initial years of its life, often used to reflect higher usage or obsolescence.

Q1: Canetoads Ltd has discovered that the estimated

Q2: Which of the following does not involve

Q4: The Harmonized Tariff System (HTS)has eliminated virtually

Q6: A railway company is required, under law,

Q7: A contingent liability is defined as a:<br><img

Q12: Entity A has provided a bank guarantee

Q21: According to AASB 107/IAS 7 Statement of

Q23: Which of the following does not fit

Q32: "Usage rates" and "user status" are important

Q39: The vast majority of India's population comprises