If  and neither

and neither  vanish, then:

vanish, then:

Definitions:

Treasury Bills

Short-term government securities with maturity periods of one year or less, offering a secure, low-risk investment option.

Optimal Weights

In portfolio management, it refers to the proportionate holdings of different assets that maximize the portfolio's expected return for a given level of risk.

Expected Rate

Anticipated return on an investment, often based on historical data or the inherent risk of the investment.

Dollar-weighted Return

This type of return measures the performance of an investment, taking into account the timing and magnitude of inflows and outflows of money.

Q2: Block A, with a mass of 10

Q4: Which of the following is NOT an

Q7: Which of the following weighs about a

Q14: 5.0 * 10<sup>5</sup> + 3.0 *10<sup>6</sup> =<br>A)

Q17: Momentum may be expressed in:<br>A) kg/m<br>B) gram.s<br>C)

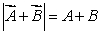

Q18: Two vectors lie with their tails at

Q31: A bullet shot horizontally from a gun:<br>A)

Q31: At December 31,2013,Morrison Company had 700 shares

Q61: Suppose that the fundamental dimensions are taken

Q70: A 5.0-kg crate is resting on a