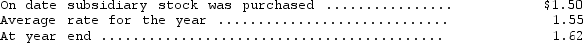

Florence Enterprises,a subsidiary of Verona Company based in New York,reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000;expenses--340,000;liabilities--880,000;capital stock--80,000,revenues--400,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Urinary Bladder

A hollow organ in the lower abdomen that stores urine from the kidneys before it is excreted.

Dysrhythmia

An abnormality in the heart rhythm, which can range from minor irregularities to severe disturbances in heart function.

Apical Pulse

The pulse rate measured at the apex of the heart, typically listened to with a stethoscope for assessing heart function.

Tachycardia

A condition characterized by an abnormally fast heart rate, typically exceeding 100 beats per minute in adults.

Q1: The unit of mass density might be:<br>A)

Q7: Two trailers, X with mass 500 kg

Q10: A bureau rests on a rough

Q16: A particle moves along the x axis

Q16: A horizontal force of 12 N

Q36: A boy pulls a wooden box along

Q38: A vector has a component of 10

Q41: The long pendulum shown is drawn aside

Q46: Under international accounting standards,cash received from interest

Q77: What is the correct treatment of a