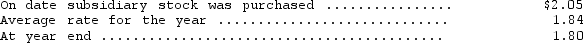

Windsor Enterprises,a subsidiary of Kennedy Company based in New York,reported the following information at the end of its first year of operations (all in British pounds) : assets--338,000;expenses--360,000;liabilities--101,000;capital stock--80;000,revenues--517,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Bad Debt Expense

An expense recorded to account for receivables that are not expected to be collected, reflecting credit losses in the financial statements.

Accounts Receivable

Outstanding payments from customers for goods or services a company has already delivered.

Average Collection Period

The average number of days it takes for a business to receive payments from its customers for invoices issued, indicative of the effectiveness of a company's credit and collection policies.

Net Sales

The amount of sales generated by a company after deductions for returns, allowances for damaged or missing goods, and discounts.

Q1: How should these stock rights be treated

Q13: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3150/.jpg" alt="Let The

Q40: One end of a 1.0-m string is

Q47: Two objects with masses, m<sub>1</sub> and m<sub>2</sub>,

Q50: In 2014,Ryan Corporation reported $85,000 net income

Q53: Two objects, X and Y, are held

Q58: Which type of contract is unique in

Q65: Sanford,Inc. ,enters into a call option contract

Q70: Ranger Company uses a periodic inventory system.If

Q73: Using the information above,service cost for the