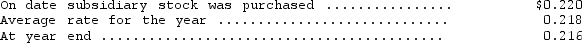

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000;expenses--6,500,000;liabilities--2,950,000;capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Investment Centre Manager

A role in charge of a business unit that is responsible for its own revenues, expenses, and assets, and is evaluated on its return on investment.

Cost Centre Manager

A manager responsible for a department or unit within a company that does not directly generate profit, focused on minimizing costs.

Narrow Focus

Concentration on a limited scope or a specific aspect of a problem, project, or field, which may restrict broader understanding or solutions.

Decentralisation

The distribution of decision-making power away from a central authority within an organization.

Q1: How should these stock rights be treated

Q8: A horizontal shove of at least 200-N

Q11: The following differences between financial and taxable

Q11: Under international accounting standards,cash paid for interest

Q14: The velocity of a particle moving along

Q37: The term "mass" refers to the same

Q41: If all temporary differences entering into the

Q43: The system shown remains at rest. The

Q52: Under international accounting standards regarding depreciation,an entity<br>A)

Q60: A force of 10 N holds an