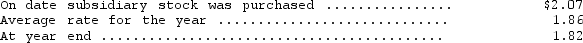

Monty Enterprises,a subsidiary of Kerry Company based in Delaware,reported the following information at the end of its first year of operations (all in British pounds) : assets--483,000;expenses--360,000;liabilities--105,000;capital stock--90,000,revenues--648,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired; a response originally elicited by the second stimulus is eventually elicited by the first stimulus alone.

Reciprocal Determinism

The idea that people choose the environments they enter and then change them.

Introverted Tendencies

Characteristics or behaviors of an individual that show a preference for inward-focused experiences and activities, often entailing less social interaction.

Stimulating Environments

Refers to settings or situations that provide a range of sensory and intellectual stimuli, potentially enhancing cognitive function and emotional well-being.

Q30: A cubic box with an edge of

Q35: When a 25-kg crate is pushed across

Q36: The SEC currently requires foreign companies that

Q39: In 2014,a company changed from the LIFO

Q39: Of the following,select the incorrect statement concerning

Q40: Which one of the following five quantities

Q44: At a stop light, a truck traveling

Q46: Under international accounting standards,cash received from interest

Q51: An object has a constant acceleration of

Q64: Gabor Company had granted 20,000 options to