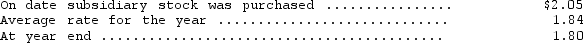

Windsor Enterprises,a subsidiary of Kennedy Company based in New York,reported the following information at the end of its first year of operations (all in British pounds) : assets--338,000;expenses--360,000;liabilities--101,000;capital stock--80;000,revenues--517,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Multicollinearity

A statistical phenomenon in which two or more predictor variables in a multiple regression model are highly correlated.

T-Tests

A statistical test used to compare the means of two groups and determine if they are significantly different from each other.

Linearly Related

Variables are linearly related if there is a consistent linear relationship between them, indicated by a straight-line graph.

Multicollinearity

A statistical phenomenon in which two or more predictor variables in a multiple regression model are highly correlated, potentially affecting the stability of the model.

Q1: A particle moves along the x axis

Q3: A right circular cylinder with a radius

Q6: Acceleration is always in the direction:<br>A) of

Q7: Proceeds from the sale of investments in

Q10: An item that would create a permanent

Q23: Which of the following contingencies should be

Q42: You stand on a spring scaleon the

Q52: The inertia of a body tends to

Q52: Which of the following concepts for postretirement

Q66: A car rounds a 75-m radius curve