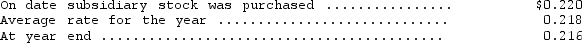

DeGaulle Enterprises,a subsidiary of Clinton Company based in New York,reported the following information at the end of its first year of operations (all in French francs) : assets--4,790,000;expenses--6,500,000;liabilities--2,950,000;capital stock--1,200,000,revenues--7,140,000.Relevant exchange rates are as follows:  As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

As a result of the translation process,what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Depression

A mood disorder that causes a persistent feeling of sadness and loss of interest, affecting how one feels, thinks, and handles daily activities.

Internal

Pertaining to or situated within something; inner, especially referring to processes or phenomena occurring within an entity or organism.

Stable

Referring to a condition or situation that is not undergoing significant change or variation and is steady or unchanging over time.

Global

Pertaining to or involving the entire world; worldwide in scope or application.

Q12: A company that receives 10 percent or

Q20: The driver of a 1000-kg car tries

Q22: A particle moving along the x axis

Q34: Under international accounting standards,remote contingent liabilities are

Q37: A 4-kg cart starts up an incline

Q44: A block of mass m is

Q49: Which of the following is true regarding

Q53: Which of the following items involving current

Q53: Which of the following items results in

Q53: Which of the following statements is correct?<br>A)