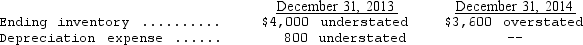

Strong Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2013 covering the years 2013,2014,and 2015.The entire amount was charged to expense in 2013.In addition,on December 31,2014,fully depreciated machinery was sold for $6,400 cash,but the sale was not recorded until 2015.There were no other errors during 2013 or 2014,and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on 2014 net income?

An insurance premium of $3,600 was prepaid in 2013 covering the years 2013,2014,and 2015.The entire amount was charged to expense in 2013.In addition,on December 31,2014,fully depreciated machinery was sold for $6,400 cash,but the sale was not recorded until 2015.There were no other errors during 2013 or 2014,and no corrections have been made for any of the errors.Ignore income tax considerations.What is the total effect of the errors on 2014 net income?

Definitions:

Marginal Utility

Marginal utility refers to the additional satisfaction or benefit one receives from consuming an additional unit of a good or service.

Pepsi

A carbonated soft drink manufactured by PepsiCo, serving as one of the most recognized brands globally in the beverage industry.

Utility Function

A mathematical representation that ranks individuals' preferences for sets of consumption bundles.

Budget Equation

A financial formula that balances income and expenditures, often used in personal finance or government budgeting.

Q1: Which of the following statements is true

Q13: A 5.0-kg crate is on an incline

Q18: McGovern Corporation,a U.S.company,owns a 100% interest in

Q18: In 1866, the U. S. Congress defined

Q20: Which of the following is correct regarding

Q45: On a statement of cash flows prepared

Q46: The following is a partial balance sheet

Q47: Interest cost relating to defined-benefit pension plans

Q56: One of the four general criteria for

Q70: The acceleration of an object, starting from