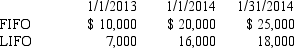

A retailing firm changed from LIFO to FIFO in 2014.Inventory valuations for the two methods appear below:

Purchases in 2013 and 2014 were $60,000 in each year.

Purchases in 2013 and 2014 were $60,000 in each year.

-Using the information above,in the comparative 2013 and 2014 income statements,what amounts would be shown for cost of goods sold? 2013 2014

Definitions:

Elastic

A description of a good's demand or supply that indicates a high sensitivity to changes in price, where a small change in price leads to a larger change in quantity demanded or supplied.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, with elasticity greater or less than one indicating the degree of responsiveness.

Quantity Demanded

The specific amount of a good or service consumers are willing to buy at a given price, holding other factors constant.

Elasticity Coefficient

A measure that quantifies the responsiveness of the quantity demanded or supplied of a good to a change in one of its determinants, such as price.

Q2: Generally accepted accounting principles require that certain

Q15: A right circular cylinder with a radius

Q15: Under the direct method,which one of the

Q18: An object is moving on a

Q21: The income statement of Faster Computers,Inc.showed the

Q23: On January 1,2014,Bijou Company purchased investment securities

Q25: A bomber flying in level flight with

Q36: Four vectors <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3150/.jpg" alt=" Four

Q52: Brooke Distributing leased a machine for a

Q73: Which of the following is NOT a