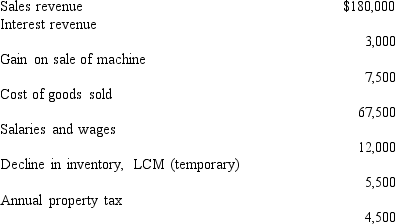

Blind Faith Company reported the following data with regard to its first quarter of operations:  The expected annual income tax rate is 40 percent.Blind Faith should report net income on the first quarter interim financial statements of

The expected annual income tax rate is 40 percent.Blind Faith should report net income on the first quarter interim financial statements of

Definitions:

Accounting Flexibility

The range of choices that management has under GAAP (Generally Accepted Accounting Principles) in how to report financial activity.

Contract Constraints

Limitations or conditions in a contract that restrict the actions of the parties involved.

Bonus Benefits

Additional compensations above the regular remuneration package, often tied to performance or specific achievements.

Discretionary Spending

Expenditure over which a government or business has control and is not mandated by laws, such as research and development or advertising expenses.

Q12: A company already has calculated its basic

Q14: A racing car traveling with constant acceleration

Q14: 5.0 * 10<sup>5</sup> + 3.0 *10<sup>6</sup> =<br>A)

Q21: A book rests on a table, exerting

Q38: A boy on the edge of a

Q54: Vast Ocean Corporation has an incentive compensation

Q64: If a company issues both a balance

Q67: A 25-N crate is held at rest

Q69: Lexan Company reported the following for the

Q73: Current generally accepted accounting principles do not