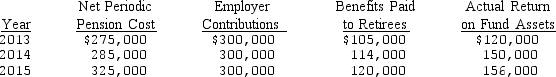

The following data relate to the defined benefit pension plan of the Brotherhood Corp.for the years 2013-2015:

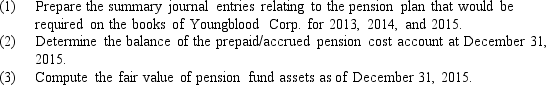

At December 31,2012,the books of Youngblood Corp.reflected a pension liability of $30,000.The fair value of pension fund assets at that date was $1,300,000.The pension fund is administered by an independent trustee.

At December 31,2012,the books of Youngblood Corp.reflected a pension liability of $30,000.The fair value of pension fund assets at that date was $1,300,000.The pension fund is administered by an independent trustee.

Definitions:

Taxation Rate

The percentage at which an individual or corporation is taxed, which can vary based on income level and type of income.

Tax-Exempt Income

Income that is not subject to tax by federal, state, or local authorities, allowing the recipient to keep the full amount.

Recognize Income

The process of reporting income when it is earned, according to accounting principles, regardless of when it is received.

Unemployment Compensation

Financial benefits provided to individuals who have lost their job through no fault of their own, as a means to temporarily assist them while they seek new employment.

Q4: When the estimate of an asset's useful

Q5: Under the cost method of accounting for

Q17: The impairment test for an intangible asset

Q28: On January 2,2009,Portier Enterprises issued $2,400,000 of

Q37: Meteor Motor Sales exchanged a car from

Q42: International accounting standards currently are moving toward

Q47: When using the if-converted method to compute

Q49: Mantle Company exchanged a used autograph-signing machine

Q52: When computing earnings per share on common

Q90: Weaver Corporation was organized on January 1,2013,at