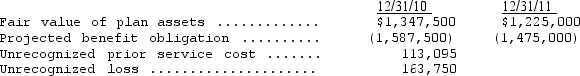

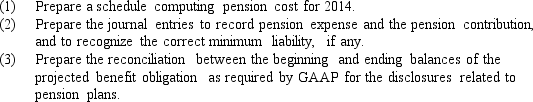

Feinberg,Inc. ,provides a noncontributory defined benefit plan for its 200 employees.Information from the company's pension footnote for the year ended December 31,2013,and partial information for the year ended December 31,2014,are given below:

The company's actuary indicated that the settlement rate and expected rate of return on plan assets were both 8% for 2013 and 2014.The company contributed $221,250 to the plan at the end of 2014.Service cost for 2014 was $125,000.

The company's actuary indicated that the settlement rate and expected rate of return on plan assets were both 8% for 2013 and 2014.The company contributed $221,250 to the plan at the end of 2014.Service cost for 2014 was $125,000.

On January 1,2013,the company amended its plan to grant retroactive credit for prior service rendered by employees prior to the amendment.This amendment increased unrecognized prior service cost by $125,000 at that date.The prior service cost is being amortized over the average remaining service life of the employees affected by the amendment.The average remaining service life of the workforce in each year has been constant at 10.5 years.

Definitions:

Delayed Onset

The commencement of symptoms or effects following an expected timeframe, often used in medical contexts to describe a delayed reaction to treatment or injury.

Middle Adulthood

A stage of life, typically considered to occur from around age 40 to 65, marked by stability, growth in professional and personal life, and often by changes in physical and cognitive abilities.

Recessive Gene

A gene that produces its characteristic phenotype only when its allele is identical—requiring two copies for the trait to be expressed.

Carriers

Individuals who have one copy of a mutated gene that can lead to certain genetic conditions but do not show symptoms themselves.

Q14: Financial information for Pinnacle Enterprises at the

Q19: 1 m is equivalent to 3.281 ft.

Q24: Which of the following should NOT be

Q28: Amortization of the premium on bonds payable

Q30: The cumulative effect on prior years' earnings

Q32: Which of the following statements regarding international

Q53: On January 1,2013,a company purchased four 5%,$1,000

Q55: A firm sold an investment in securities

Q68: The vested benefits of an employee in

Q70: The acceleration of an object, starting from