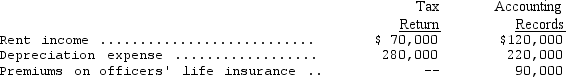

Bodner Corporation's income statement for the year ended December 31,2014,shows pretax income of $1,000,000.The following items are treated differently on the tax return and in the accounting records:  Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Assume that Bodner's tax rate for 2014 is 30 percent.What is the amount of income tax payable for 2014?

Definitions:

Potential Valuations

Estimated values assigned to businesses, assets, or investments based on future earnings power or asset values.

Forecasts

Future predictions about various aspects such as sales, weather, economic trends, based on historical data, current conditions, and analytical models, crucial for planning and preparation.

Budgets

Financial plans outlining an organization's projected revenue, expenses, and cash flow over a specific period.

Marketing Mix Plans

Strategies that involve the adjustment and optimization of product, price, place, and promotion to effectively engage with a target market.

Q16: When enacted tax rates change,the asset and

Q19: The amortization of patents should be presented

Q26: Which of the following is not an

Q32: For a bond issue that sells for

Q43: Tongass had pretax accounting income of $1,400

Q55: During 2014,Belladonna Corp.had outstanding 125,000 shares of

Q58: Which of the following is the most

Q58: In order to calculate the third year's

Q59: Which of the following is an example

Q72: On May 1,2013,H.Campbell acquired $300,000 of Cobbler